ATO announce that Fringe Benefits Tax (FBT) is on their hit list for compliance reviews

- Rhythm Financial

- Apr 5, 2024

- 4 min read

Updated: Apr 2

Typically, poor record-keeping and lack of planning are the primary shortcomings for businesses when it comes to their FBT compliance.

Understanding what is a Fringe benefit can significantly impact your planning, employee retention and tax compliance:

💡 Read our blog here to better understand the most common Fringe benefits provided to employees and their associates that you need to review and consider.

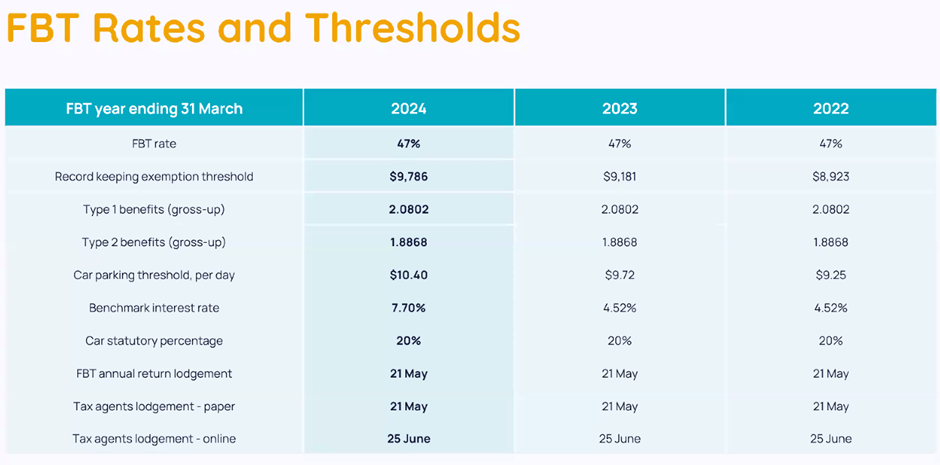

The 2024 Fringe Benefits Tax (FBT) year-end completed on 31 March 2024.

We would like to bring to your attention important updates regarding changes to FBT coming into effect.

The ATO have announced that FBT is on their hit list for compliance reviews so please ensure, as a business owner, you are up to date with the rules and your obligations.

As part of these ATO reviews they will be extending the Random Enquiry Program to Employers. These random checks will involve employers needing to provide detailed information to demonstrate compliance with tax obligations for FBT, PAYG and super so please ensure your records are up to date.

The most common Fringe benefits provided to employees and their associates that you need to review and consider include:

FBT on cars, other vehicles, parking, and tolls (provide an employee with private use of a passenger vehicle)

Entertainment (Sporting events, Christmas parties & meals and alcohol)

Expense payment benefits (car parking, home mortgage expenses, cost of acquiring a home/desktop computer, mobile & home internet costs, and health insurance premiums)

Loan and debt waiver fringe benefits (lending money to an employee at an interest rate below the ATO statutory interest rate and selling goods to an employee without the requirement to pay the invoice for the goods)

Accommodation and location related fringe benefits (providing accommodation for your employee rent-free or at a reduced rent for their usual place or residence)

Property fringe benefit (physical goods such as clothing or a television, gift cards and other non-cash benefits)

Residual fringe benefits (use of employer’s property such as a video camera or television, a service such as advice given by a solicitor, insurance cover such as a group health insurance policy and private use of a motor vehicle that is not a ‘car’ for FBT purposes such as a one-tonne Ute)

Car Fringe Benefit

The ATO are also data matching information in relation to vehicle novated leases, through a variety of external providers, to ensure compliance with motor vehicles and FBT obligations.

Please review the below table to ensure you are familiar with the exemption rules regarding motor vehicles.

Remember, even if your vehicle is a Ute it does not mean that it is exempt from FBT. For a Ute to be FBT exempt it must meet the eligibility rules for an exempt vehicle and the private use must be limited.

FBT Updates

New exemption for Electric Vehicles

From 1 July 2022, employers do not pay FBT on eligible electric cars and associated car expenses. The FBT savings can be significant if you have an eligible vehicle. Employers need to carefully consider their salary packaging policies and offerings including their own vehicles.

FBT exemption applies if you provide private use of an electric car that meets all the following conditions:

The car is a zero or low emissions vehicle

It is a car designed to carry a load of less than 1 tonne and fewer than 9 passengers

The first time the car is both held and used is on or after 1 July 2022 (new or second hand)

Luxury Car Tax (LCT) has never been payable on the importation or sale of the car (new or second hand)

The car is used by a current employee or their associates (such as family members)

Benefits provided under a salary packaging arrangement ARE included in the exemption

Other things to note:

The government will complete a review into this exemption by mid-2027

Plug-In Hybrids – exemption ends 1 April 2025, unless financial commitment in place prior

Even if the benefit is exempt (or taxable), the Reportable Fringe Benefit Rules apply (unless Pooled or Shared Car)

Car Parking

A parking facility will be a commercial car parking facility if it is operated by a car parking operator. This includes a parking facility that exists within another complex (such as an office, shopping centre or hospital) where the owner or lessor of that complex outsources the management of the parking facility to a car parking operator.

Where a parking facility is not managed by a car parking operator, it may nevertheless be a commercial car parking facility if it displays other hallmark characteristics, namely, if the parking facility:

has clear signage visible from the street advertising that paid parking is available

has mechanisms to control who can enter and/or exit the parking facility, or park at the facility. This may include boom gates, or 'pay and display' ticketing machines

charges more than a nominal fee (usually a significantly lower rate than the local market rate) for paid parking. This includes charging a user for parking which is not all-day parking (such as parking at an hourly rate).

Generally, if a parking facility displays two or more of these characteristics, it is a commercial car parking facility. However, the characteristics of a particular parking facility must be objectively considered.

Record-keeping Concession

The government will now allow employers to use existing corporate records, rather than prescribed records, to comply with their FBT obligations.

Instead of requiring employers to create additional records and employee declarations, the Commissioner will have the power to determine adequate alternative records, allowing employers to rely on existing corporate records and reduce compliance costs.

These legislative changes will take effect from 1 April 2024, and employers should prepare in advance to simplify their record-keeping. See additional details from the ATO here: Changes to fringe benefits tax record keeping.

FBT Information

For a full list of how FBT affects you and what you need to consider please refer to the ATO details here: Fringe Benefits Tax.

If you have any questions or would like to arrange a meeting to discuss your fringe benefits circumstances, please contact the office on (07) 3193 9455.

Commentaires